After TPP, Vietnam searches for other trade avenues

Latest

| Vietnam and other countries continue TPP negotiations | |

| Vietnam, Japan beef up partnership in industry, trade, energy |

Losing liberalisation

Vietnam may be doing well with its exports amid a global trade slowdown influenced by protectionist trends, but the nation could still be affected by the downturn in the future.

Notably, the US’s withdrawal from the Trans-Pacific Partnership (TPP) has dampened trade prospects in one of Vietnam’s biggest markets, according to Douglas Lippoldt, the London-based chief trade economist at HSBC Global Research.

“When the US pulled out of TPP…it reduced some of the liberalisation that we were hoping for,” said Lippoldt. “We wanted to see Vietnam getting better access to the US textiles and apparel market, for example, because duties on these products in the US are high compared to other sectors.”

This lost liberalisation limits Vietnam’s growth potential along one corridor. “The liberalisation slowdown with the US is a bit of a burden and one way to offset it is to have more liberalisation in the region,” he said.

Seeking other outlets

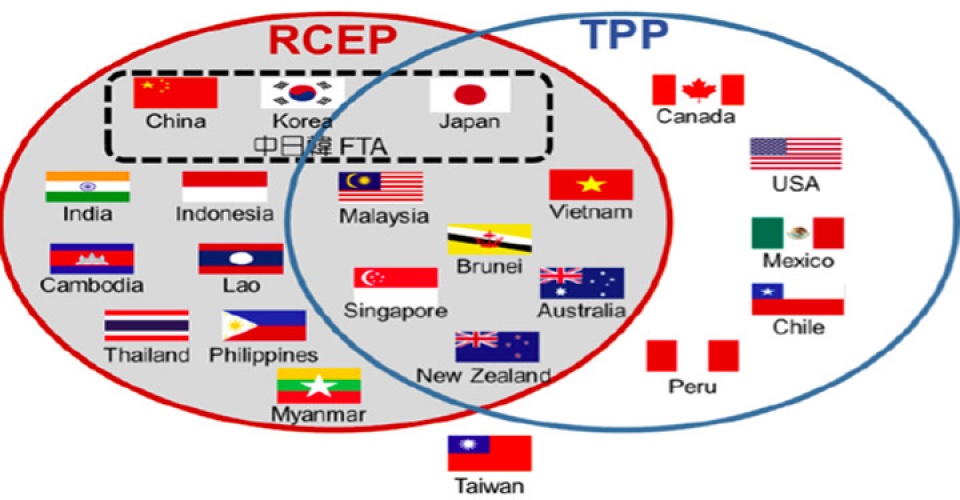

The ongoing negotiations on the Regional Comprehensive Economic Partnership (RCEP), meanwhile, could support Vietnam’s integration into pan-Asian supply chains.

“The increased openness in Asia that will come from this is important because it’s opening corridors that haven’t been fully liberalised before, like the trade routes between China and India,” Lippoldt said.

The RCEP accord, which is under negotiations, will improve access in Asia for Vietnam’s exports, and it will also enable Vietnam to seek inputs for production purpose more freely from across the region.

|

| RCEP vs TPP. (Photo: Bloomberg) |

“Having access to the most competitive suppliers anywhere in the region is very important because it helps Vietnamese businesses to be even more competitive,” Lippoldt said. “So it’s a win-win kind of solution, making Vietnam more competitive not just in Asia but anywhere [in the world].”

What’s more, the EU-Vietnam Free Trade Agreement will be able to open new corridors for Vietnamese firms to seek inputs from the EU at lower costs, thanks to lower tariffs.

“On the export side, tariffs and other impediments to trade at the border will be reduced in areas of interest for Vietnam, such as textiles and apparel, and agriculture. So market success should improve for Vietnamese products ranging from T-shirts to coffee, for example,” Lippoldt said. “There will be new opportunities to diversify, and this matters because diversification can help to keep Vietnamese trade robust and resilient if there is a problem somewhere in the global economy.”

Pushing manufacturing and services

According to World Trade Organization (WTO) metrics, Vietnam’s merchandise exports, mainly including agricultural and industrial products, grew annually at 16% from 2010-2016.

Commercial services trade, including transport, tourism, and other services, recorded an annual bump of 9% in the period. HSBC Research reported an average world trade growth of 5.07% per year in the 2010-2016 period.

There is much foreseeable potential for Vietnam’s service exports. HSBC anticipates there will be 2.6 billion new members of the middle class in emerging markets by 2050.

“As their incomes rise, these consumers will boost their consumption of imported products, including tourism,” Lippoldt said.

“While services trade can help Vietnam to diversify its export basket, I don’t think this is a substitute for manufacturing. Manufacturing will remain a main part of the country’s trade, and more can be done in manufacturing.”

According to Lippoldt, Vietnam can invest in higher value-added activities in its supply chains when it moves to different stages of the production process such as design or innovation.

These higher value-added activities may involve “developing brands or giving customers of Vietnam brand awareness, finding ways to innovate to make Vietnamese products different from competitors. If you compete just in generic products, then the global competition is very tough and it’s hard to grow your margin, your profit,” Lippoldt said.

“But if you have a special brand that people are willing to pay extra for because they want this product or that product from Vietnam, then you have even better prospects.”

| Vietnamese textile sector overcomes TPP fall-back in style With no sharp increase in sight, and despite a reduced number of projects in recent years, the Vietnamese textile industry still attracts more than $750 ... |

| TPP negotiation continued without US The chief negotiators from the 11 Trans-Pacific Partnership countries met in Hakone, Kanagawa Prefecture, southwest of Tokyo, on July 12 to discuss how to bring ... |

| Ministers of 11 TPP member countries to meet in Ha Noi Ministers from 11 countries joining the Trans-Pacific Partnership (TPP) are scheduled to gather in Ha Noi on May 21, with Japan pushing for the free ... |